Tax on Alcohol in Sri Lanka

Alcohol Taxation in Sri Lanka: A Comprehensive Overview

Sri Lanka has a thriving alcoholic beverage industry, and the tax revenue generated from this sector plays a significant role in the country’s fiscal framework. The Ministry of Finance and the Department of Excise are the key authorities responsible for imposing taxes on alcoholic beverages in Sri Lanka. Currently, two taxation methods are in place, the bulk liter method and the unit-based or volume-based method, each applied to specific alcoholic products.

The bulk liter method is primarily employed in taxing Toddy.

For all other alcoholic beverages in Sri Lanka, the government follows a unit-based or volume-based taxation method.

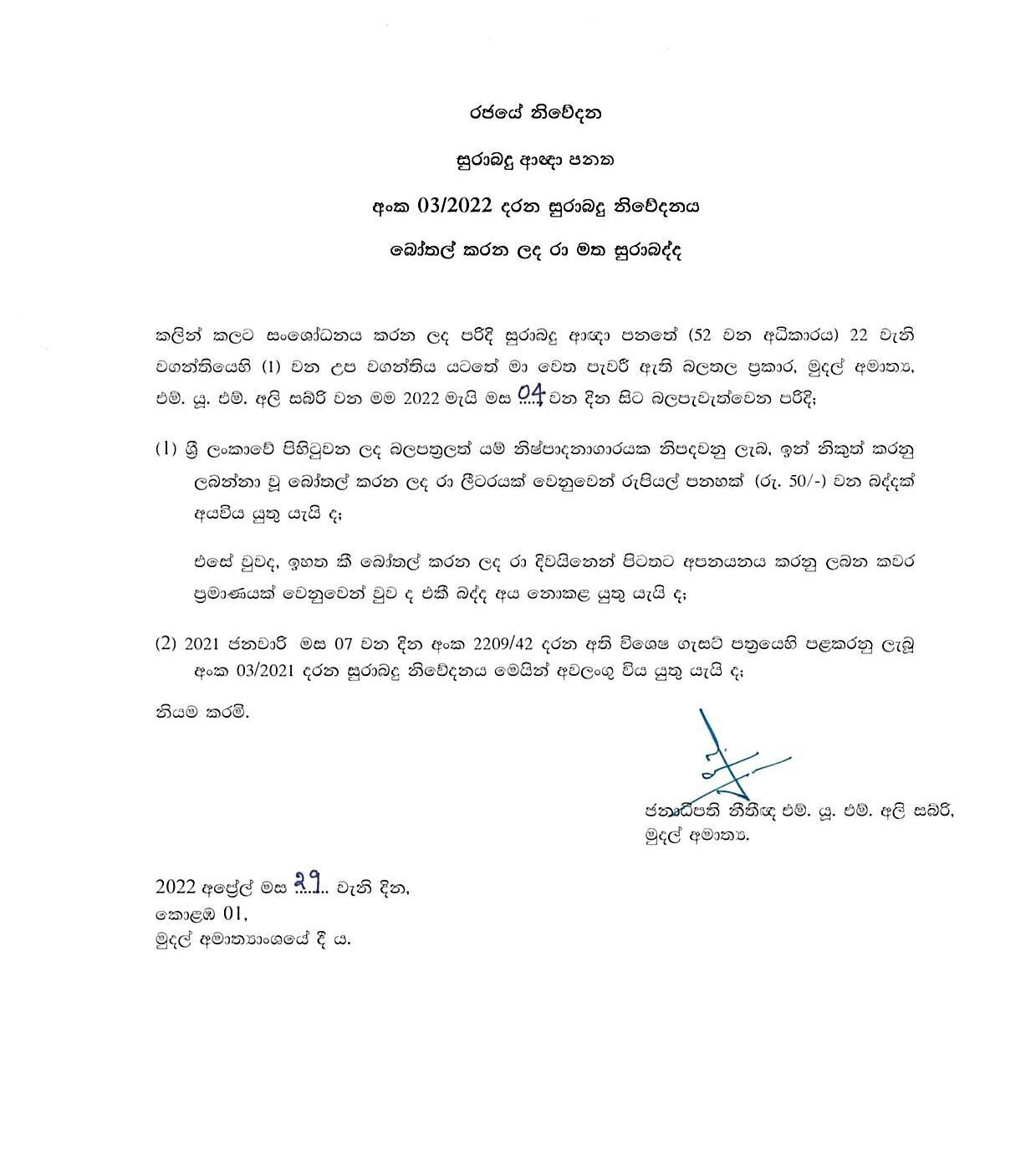

As of 2023, the taxation of Toddy is governed by Excise Notification 03/2022.

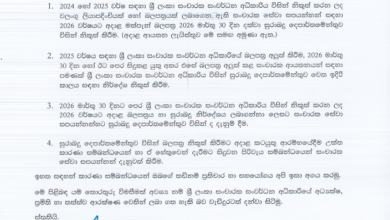

For all other alcoholic beverages, the latest taxation policies are laid out in Excise Notification 02/2023.

imported alcoholic products are subject to taxation through a separate notification, 08/2019, which applies distinct regulations to ensure compliance and revenue collection from these products.

Taxation in the alcoholic beverage industry in Sri Lanka plays a pivotal role in revenue generation for the government and regulating the market.

Duty on Liquor

Toddy Tax

Import Tax